Summary

Unlocking Interchain DeFi: How Injective Creates a Unified Entry Point discusses the innovative solutions Injective offers to improve decentralized finance (DeFi) through cross-chain interoperability. Key Points:

- Injective addresses DeFi liquidity fragmentation by enabling cross-chain interoperability, allowing users to access liquidity from multiple blockchain networks.

- Enhanced interoperability with Injective facilitates seamless asset transfers and trading between various blockchains, boosting DeFi efficiency and flexibility.

- Injective's decentralized governance model empowers community-driven innovation and development, ensuring the platform evolves according to user needs.

Injective: Tackling DeFi Liquidity Fragmentation Through Interoperability

Injective Protocol offers a robust solution for addressing the issue of liquidity fragmentation in the decentralized finance (DeFi) space by aggregating liquidity from multiple decentralized exchanges (DEXs) and DeFi protocols. By utilizing a cross-chain interoperability layer, Injective enables the seamless transfer of assets between different blockchain networks. This approach not only enhances accessibility but also boosts trading efficiency by reducing both slippage and impermanent losses.Furthermore, Injective leverages the Inter-Blockchain Communication (IBC) protocol to ensure smooth cross-chain transactions. IBC standardizes communication between diverse blockchains, allowing Injective to integrate with various DeFi ecosystems effortlessly. This interoperability is crucial as it facilitates the transfer of liquidity, assets, and data across multiple chains, thereby amplifying the reach and effectiveness of Injective's liquidity aggregation services. Through these innovations, Injective significantly improves trading experiences within the crypto ecosystem.

Enhanced Interoperability and Efficiency in Decentralized Finance: The Power of Injective

With the integration of Injective's Interchain Standard (ICS) module, seamless communication and asset transfer between any Cosmos-based and non-EVM blockchain is now possible. This breakthrough fosters cross-chain collaboration, significantly expanding the reach and capabilities of DeFi applications. Furthermore, Injective's adoption of AI technology has revolutionized its order-matching engine and automated market-making algorithms. These advancements enable faster, more efficient trade execution, real-time risk management, and personalized trading experiences for users. Consequently, these innovations not only enhance operational efficiency but also provide a robust framework for future growth in decentralized finance.Interoperable Innovation: Injective′s Cross-Chain Capabilities

Injective's innovative approach includes a dynamic gas auction mechanism that adjusts transaction fees based on real-time network demand. This ensures users only incur necessary costs for processing their transactions, enhancing economic efficiency and user experience. Moreover, Injective's interoperability extends beyond the Cosmos ecosystem to major layer 1 networks like Ethereum, Solana, and Polygon. This cross-chain capability enables seamless asset and data transfers across various blockchain environments, promoting greater connectivity and flexibility within the decentralized finance landscape.Injective's financial framework revolves around its native utility token, INJ. This versatile token performs multiple functions within the ecosystem, including governance roles, participating in token burn auctions, and staking on the PoS network. The initial issuance of INJ is capped at 100 million tokens, with an incremental increase over time through reward mechanisms. Initially, INJ inflation is targeted at 7% but will gradually taper down to 2%. According to CoinMarketCap data, the INJ token is listed on more than 90 exchanges.

Decentralized Governance and Interoperability Empower Injective′s Growth

Injective's decentralized governance model, powered by the INJ token, empowers the community to shape the protocol's future. Through voting on key decisions and protocol upgrades, this transparent and inclusive approach fosters a sense of ownership among participants and ensures long-term sustainability. Additionally, Injective's interoperability with other blockchain networks is facilitated by cross-chain bridges and IBC (Inter-Blockchain Communication). This feature enables seamless transfer of assets and data between different ecosystems, thereby expanding the protocol's reach. It also unlocks new opportunities for cross-chain trading and collaboration, making Injective a versatile player in the blockchain space.Harnessing Innovation and Community-Led Governance

Injective utilizes a decentralized governance model driven by its native INJ token, giving community members the power to collaboratively determine strategic directions for platform development, upgrades, and ecosystem projects. This democratic approach ensures that decisions reflect the collective interests and insights of stakeholders.Moreover, Injective's steadfast dedication to innovation is highlighted by its pioneering features like cross-chain margin trading. This functionality allows traders to leverage assets across various blockchains, opening up new trading possibilities and optimizing capital efficiency. By integrating these advanced features, Injective not only enhances user experience but also sets a new standard in the realm of decentralized finance.

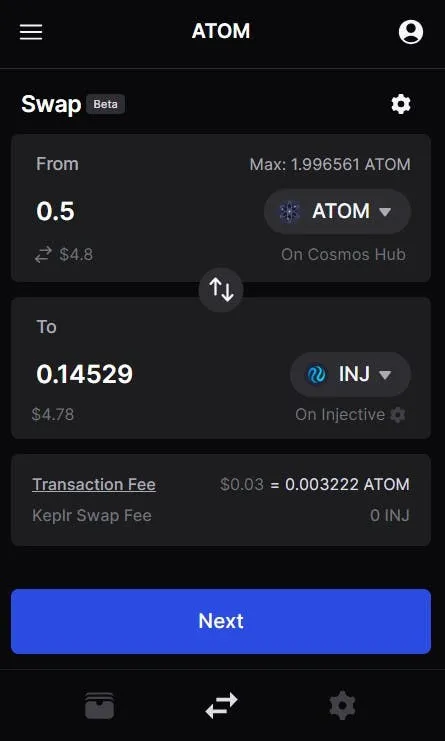

Injective: Empowering Cross-Chain Swaps and Community Governance

Injective's decentralized exchange (DEX) utilizes an advanced Inter-Blockchain Communication (IBC) protocol, allowing for effortless cross-chain trading of perpetual swaps among various networks such as Cosmos, Ethereum, and Polkadot. This technology streamlines the trading process and enhances liquidity across multiple blockchain ecosystems.The Injective Protocol is underpinned by its native token, INJ, which plays a crucial role in network operations. INJ is used to pay transaction fees, distribute staking rewards, and enable governance participation within the community. This multifaceted utility not only incentivizes active participation but also strengthens the overall stability and security of the platform. The engaged community that arises from these incentives contributes significantly to the ongoing development and success of Injective's ecosystem.

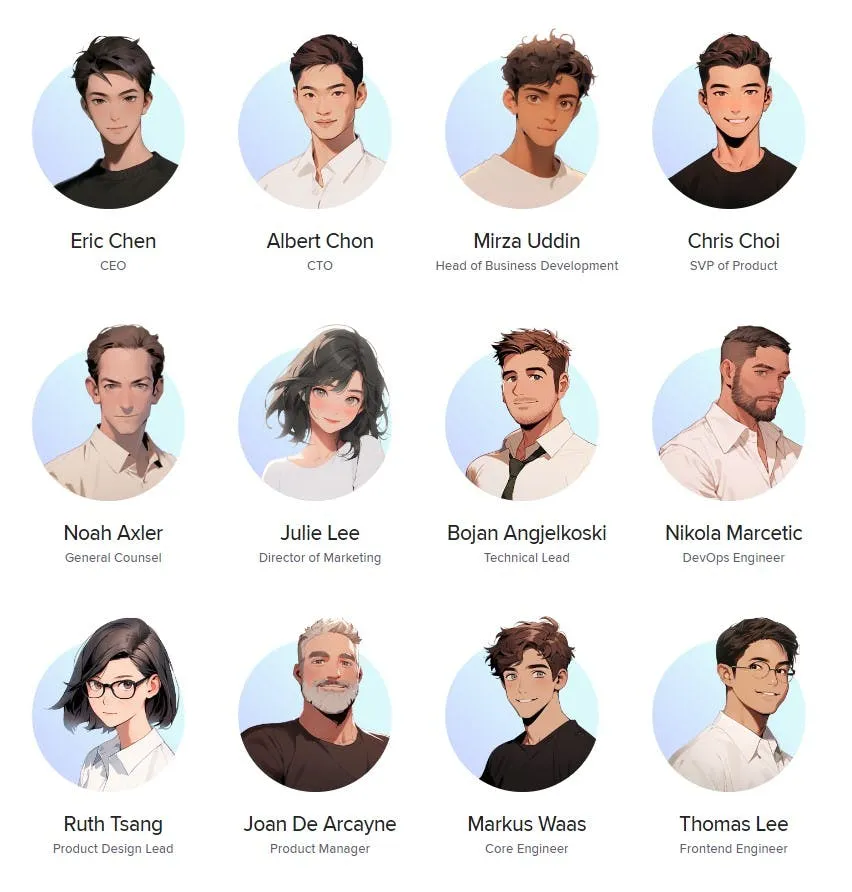

United by a shared vision, the team at Injective is dedicated to making financial access more democratic through their innovative platform. Their combined efforts have thrust Injective into the limelight of blockchain advancements, enabling both developers and users to explore new possibilities in the world of decentralized finance (DeFi). As the saying goes, seeing is believing.

Injective Hub serves as a gateway for those eager to dive into the Injective ecosystem. This all-in-one platform equips users with an array of tools designed to unlock various DeFi features, ensuring a seamless and comprehensive experience.

Injective’s key functionalities are conveniently accessible in a single location for users. A pivotal element of Injective's infrastructure is the Injective Bridge, which allows effortless asset transfers from various other networks into Injective. Currently, this bridge supports approximately 20 different networks.

The DAO mechanism empowers users to actively engage in the Injective ecosystem, fostering its sustainable growth. By holding INJ tokens, participants can cast their votes on a variety of proposals concerning blockchain enhancements and key decisions.

The Insurance Funds feature offers a safety net for users against potential losses in DeFi platforms powered by Injective. By creating insurance pools for derivatives markets, users can step into the role of insurers by contributing their assets to these funds.

Injective has rolled out a groundbreaking auction mechanism aimed at curbing token circulation. Every week, the platform gathers 60% of the trading fees generated by users and places these funds into an auction. Here, community members can use their INJ tokens to place bids. The victor of this auction takes home these collected fees, but there's a twist: their winning bid is permanently removed from circulation, effectively decreasing the total number of INJ tokens in existence.

Staking on the Injective network gives users the opportunity to lock up their INJ tokens, allowing them to earn passive income while simultaneously enhancing the network's security. As of now, stakers can enjoy an annual percentage rate (APR) of 15.20%. Over 56 million tokens have already been staked in total.

Validator Incentives and the Security of Injective

Validators play a crucial role in the Injective network by participating in consensus mechanisms. Their involvement is fundamental to securing the network, ensuring its robustness, and maintaining high performance standards. Validators are responsible for validating transactions and blocks, thereby guaranteeing the integrity of the blockchain.One key aspect of this system is the commission structure within the Injective staking mechanism. This structure plays an essential role in incentivizing node operators and distributing rewards among stakers. The commissions collected by validators serve as compensation for their efforts and resources dedicated to maintaining the network's security and efficiency. In turn, these incentives motivate more participants to become validators or delegators, which further enhances the network’s decentralization and resilience.

The dynamic nature of commission rates allows for flexibility and adaptability, ensuring that validators remain motivated to provide optimal service while also offering fair returns to stakers. This balance between validator incentives and staker rewards is critical for sustaining long-term engagement within the Injective ecosystem.

By understanding these components—validator participation in consensus processes and a well-structured commission framework—it becomes evident how they collectively contribute to a secure, robust, and high-performing blockchain environment on Injective.

Once you have acquired your INJ tokens and linked your wallet to the Injective Hub, you can proceed by clicking on the Delegate Now button. In the subsequent window, input the quantity of tokens you wish to delegate, hit the Delegate button, and confirm the transaction within your wallet.

Welcome aboard! You've officially become a part of the Injective ecosystem. Now that we've gone through the core elements of Injective HUB, let's dive into the additional features this ecosystem has to offer. On the Helix decentralized exchange—fully backed by Injective Labs—you'll find numerous trading opportunities waiting for you.

Helix Prioritizes User Control and Security in Blockchain

Helix stands out in the crowded blockchain space by utilizing cutting-edge decentralized storage technology. This ensures immutable and highly secure data management, which is crucial for maintaining the preservation and integrity of user assets and transaction records. By employing such advanced technology, Helix guarantees that all information remains tamper-proof and trustworthy.Another significant advantage of Helix is its seamless integration with popular digital wallets. This feature allows users to maintain full control over their private keys while accessing the platform's services without compromising the security or custody of their digital assets. Users can interact with Helix confidently, knowing that their sensitive information remains protected at all times.

In essence, Helix not only provides robust technological solutions for data management but also prioritizes user control and security, making it a reliable choice for individuals seeking a secure and efficient blockchain platform.

In the latest update, Helix has reached a significant milestone by surpassing $14 billion in total derivatives volume. Mito, previously known as Project X, is a Web3 protocol that integrates strategic vaults for generating passive yield, impermanent loss (IL) protected automated market makers (AMMs), and an efficient one-click launchpad.

Multi-Chain Yield Aggregators and Innovative NFT Projects Drive DeFi Evolution

In the ever-evolving landscape of decentralized finance, Black Panther Protocol emerges as a pioneering force not only in asset management but also in multi-chain yield farming aggregation. This dual offering enables users to maximize their earnings by optimizing investment strategies across various protocols and blockchain networks. Such advanced features make it a compelling choice for both novice and seasoned investors looking to diversify their portfolios while ensuring optimal returns.Moreover, the Berb Token stands out as an innovative venture within the NFT sphere on the Injective chain. This exclusive NFT collection provides holders with unique access to a range of perks and rewards, fostering a vibrant community of enthusiasts dedicated to exploring and expanding the potential of non-fungible tokens. By integrating these dynamic elements into its ecosystem, Berb Token not only enhances user engagement but also adds significant value to the overall Injective chain environment.

Together, these advancements underscore a broader trend towards more intricate and rewarding DeFi solutions that cater to diverse user needs while pushing the boundaries of what decentralized technologies can achieve.

The Hydro Protocol offers users a powerful tool to elevate their decentralized finance experience through the LSDFi framework, managed by Hydro and integrated into the Injective network. By utilizing Hydro's LSD, users can retain their stakes while also deploying their liquidity for optimized activities across various decentralized applications (dApps), such as trading and lending. This groundbreaking system ensures that users can fully leverage and maximize the potential of their assets within the DeFi ecosystem. The Injective team is spearheaded by co-founders Eric Chen and Albert Chon.

Albert Chon previously worked as a software engineer at Amazon Web Services and served as a consultant at Open Zeppelin.}

{Eric Chen, on the other hand, was a researcher at Innovating Capital focusing on trading strategies and protocol research. Prior to that, he contributed to the NYU Blockchain Labs.}

{Together, Eric and Albert assembled a team of developers skilled in blockchain technology, software development, and finance.}

{The rapidly growing Injective ecosystem now supports over 200 decentralized applications across various Web3 categories, underscoring its dedication to fostering an open and inclusive financial environment.

The Foundation of DeFi: Injective′s PoS Blockchain and DEX

The Injective Chain stands out as a Proof-of-Stake (PoS) blockchain meticulously crafted to cater to the financial sector. It is optimized for speed and security, ensuring transactions are processed swiftly and with minimal cost. This makes it an excellent foundation for developing decentralized finance (DeFi) applications, offering a robust platform that supports various advanced features.Complementing this infrastructure is the Injective Protocol, a decentralized exchange (DEX) protocol designed for trustless and secure cryptocurrency trading. Employing a distinctive order book model, the protocol facilitates rapid and efficient trade execution, thereby addressing common inefficiencies in traditional DEXs. Together, these technologies foster an ecosystem that empowers users with reliable and scalable DeFi solutions.

Injective′s Ecosystem Enhancements Drive Innovation and Scalability

The integration of Injective Explorer V2 and the Wormhole Bridge significantly enhances asset bridging capabilities within the Injective ecosystem. This seamless connectivity allows for easy transfer of EVM and Solana assets, including popular DeFi and NFT tokens, thereby expanding the utility and reach of these digital assets.Additionally, the introduction of Injective Orbital Chains marks a pivotal development in fostering innovation and scalability. These interconnected sovereign chains provide developers with the flexibility to create custom-built chains tailored to specific application requirements. By doing so, they not only cater to diverse use cases but also enhance performance efficiency across various blockchain applications.

Through these advancements, Injective is poised to become a more robust platform that supports a wider array of decentralized applications (dApps). The strategic enhancements in its infrastructure underscore its commitment to driving forward technological progress within the blockchain space while ensuring user accessibility and operational fluidity.

Looking for ways to stay updated with the latest gaming trends and news? We've got you covered. Here are some essential platforms where you can connect with fellow gamers and get real-time updates on your favorite titles.

First up, visit our Website. It's your primary hub for all things gaming, offering in-depth reviews, breaking news, and exclusive interviews with industry leaders.

Next, join us on Twitter. Our feed is a quick-fire way to catch up on the latest announcements, trailer drops, and live event coverage as they happen.

For more interactive discussions and community engagement, check out our Telegram channel. It's a fantastic place to share insights, participate in polls, and get involved in lively conversations about upcoming releases.

If you're looking for a more immersive experience, hop into our Discord server. Here you'll find dedicated channels for different games where you can team up with other players, share tips and strategies, or just hang out and chat.

Lastly, don’t miss out on our Reddit community. This is where fans gather to delve into deeper discussions about game mechanics, lore theories, and much more. It’s an excellent platform for both casual fans and hardcore enthusiasts alike.

By following these channels—Website | Twitter | Telegram | Discord | Reddit—you'll always be at the forefront of gaming culture.

ALL

ALL

Discussions